Organic Fruit & Vegetables: A big opportunity for Premium and NPD, with the right focus

A surge in demand from locked-down shoppers helped sales of organic produce in the UK rise by 12.6% to £2.79bn in 2020 – the category’s highest growth level in 15 years, according to The Grocer.

This presents a big opportunity for producers if they are aware of what shoppers expect in the category. Our analysis shows what UK shoppers are looking for and how their needs compared to the rest of the store.

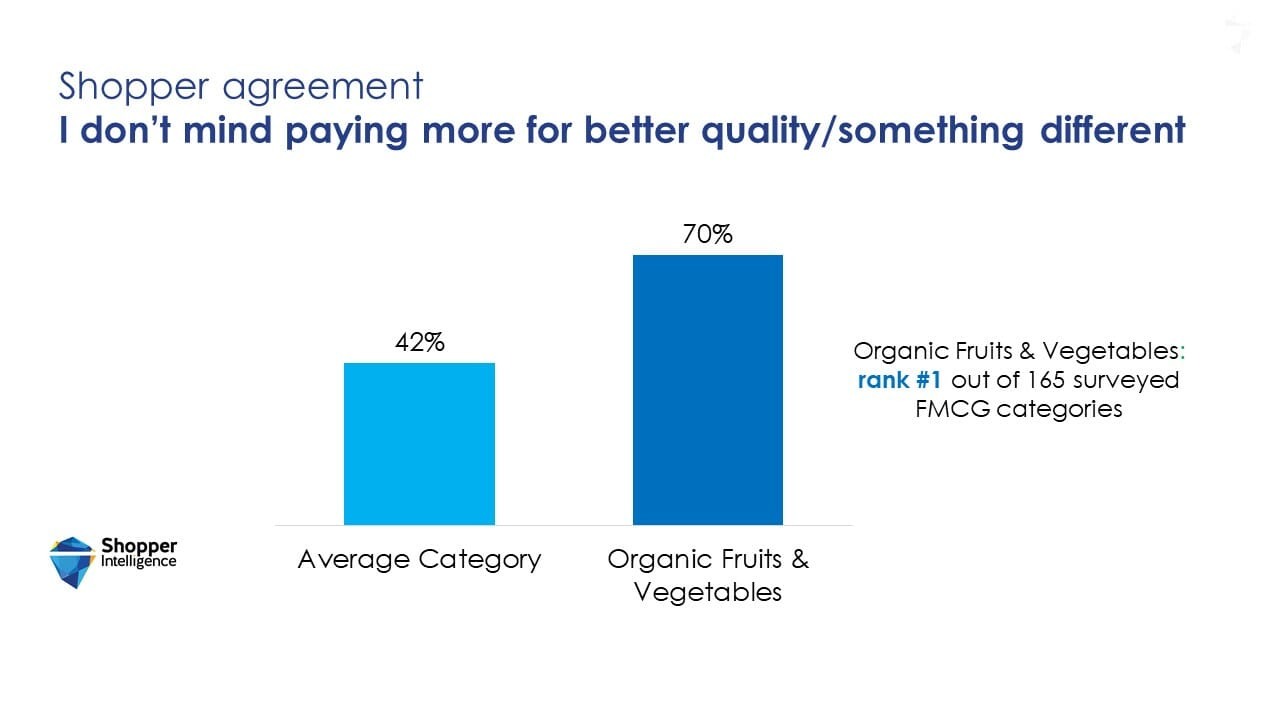

Fruit & Vegetables is the number one category across the store where shoppers are most likely to agree they ‘don’t mind paying more”, 70% agreement with this statement versus only 42% for the average category. Clearly, this represents a huge opportunity for driving total store spend by ensuring a good selection of premium options are both available and clearly signposted for shoppers.

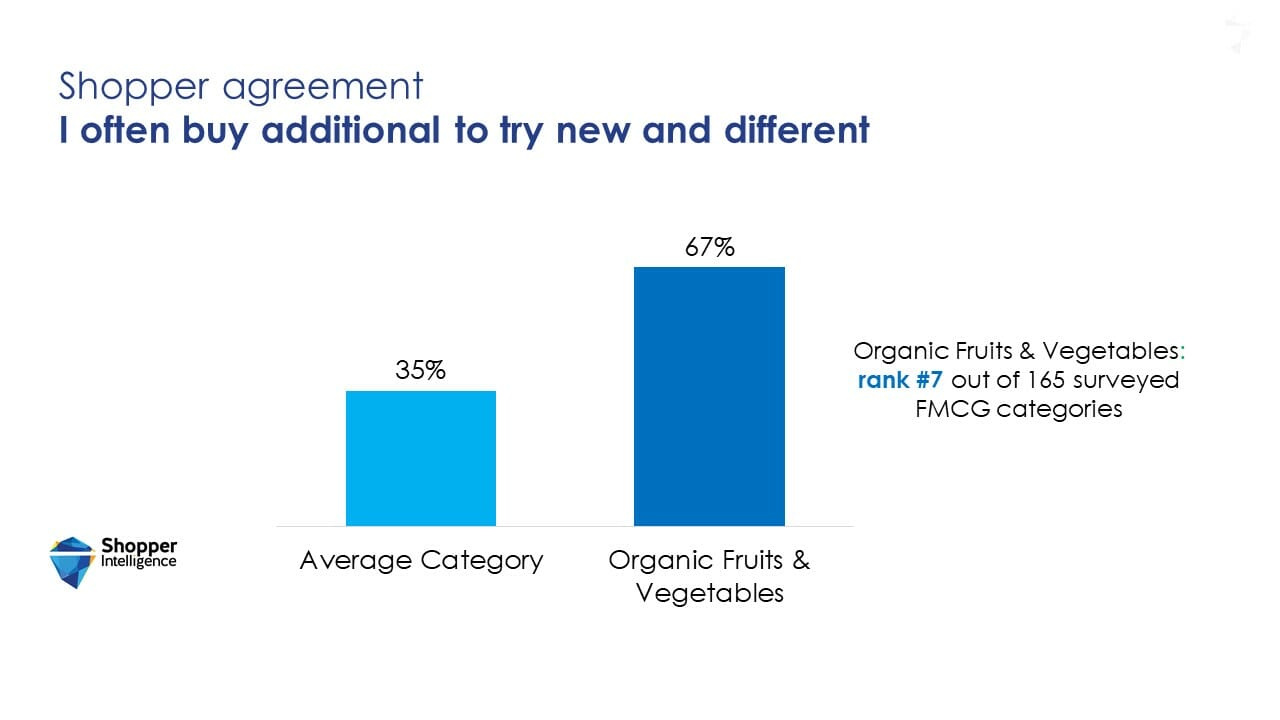

In fact, delivering this via NPD is also a great way that Organic Fruit & Vegetables can help drive store spend. Shoppers are significantly more likely to agree they will, ‘often buy additional to try new and different’, 67% agreement versus only 35% for the average category across the store.

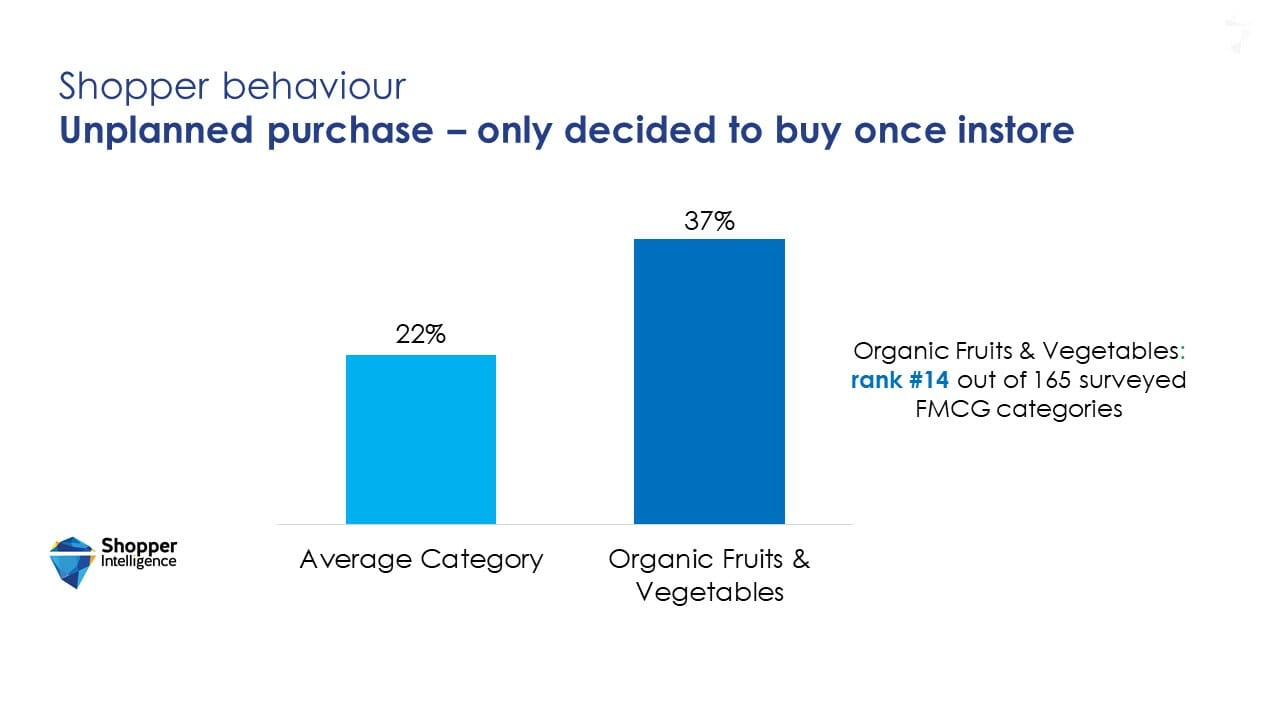

Working on these types of aspects will also require specific activation in-store, in particular given that Organic Fruits & Vegetables is such a heavily impulse-driven category compared to standard Fruit & Vegetables.

37% of Organic Fruits & Vegetable shoppers only decide to buy once in the store, compare that to standard Fruit & Vegetables where only 20% buy on impulse – similar to the average category at 22%. So, using elements like POS and display will be very important to ensure that Premium and NPD has the best chance of success.

There are other aspects that Organic Fruit & Vegetables could consider to help meet shopper requirements for Premium and NPD.

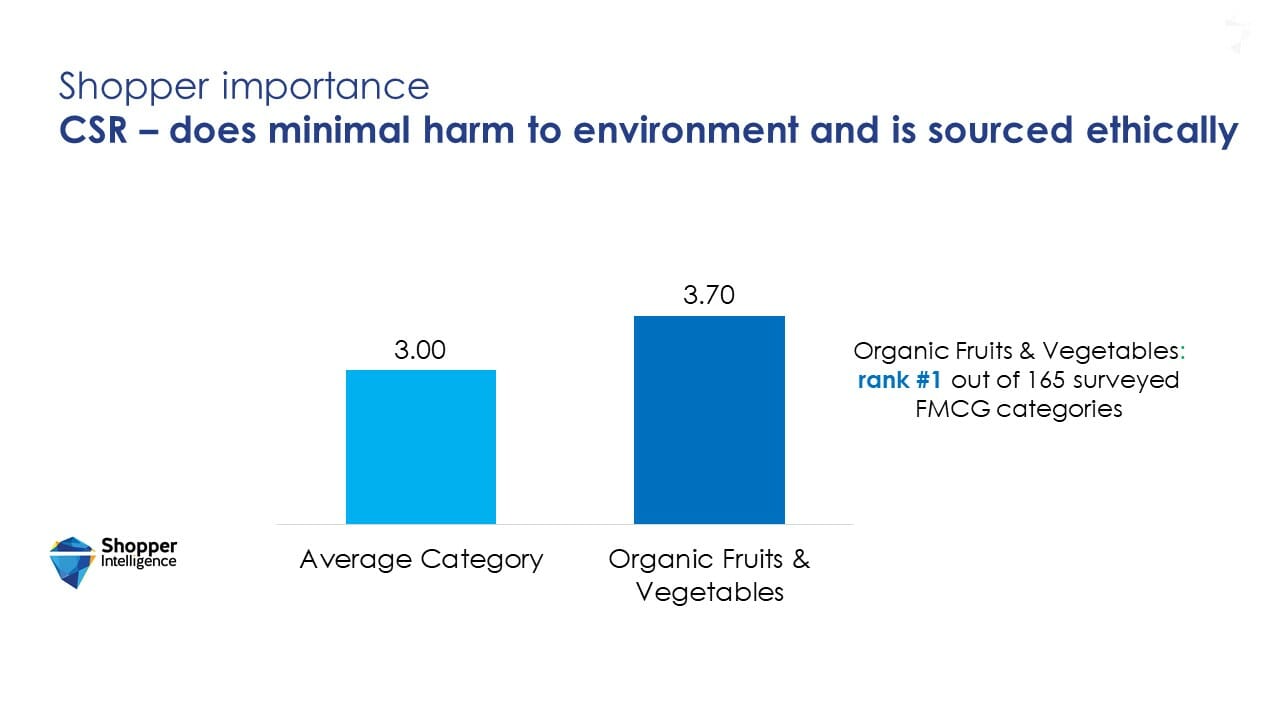

For example, shoppers are significantly more likely to cite CSR aspects as being important to them – Organic Fruit & Vegetables is the number one ranked category in store for this with a rating of 3.7 compared to a store average of only 3.0. To find out more about how your category is doing vs the rest of the store across retailers, read our summary on Measuring Performance.

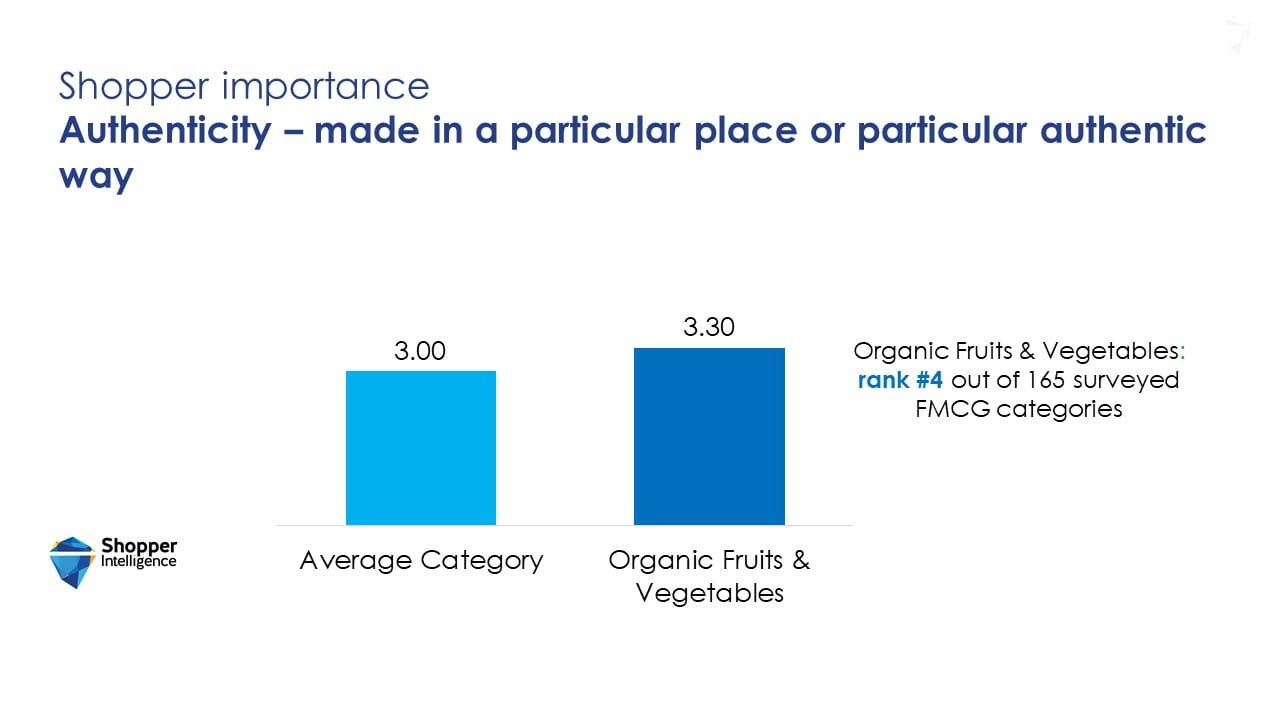

Authentic options are also extremely important for Organic Fruit & Vegetables shoppers with a rating of 3.3. versus 3.0 for the average category – resulting in the category ranking 4th overall. Thus, communications and on pack messaging focussed on the provenance of products and the methods used to grow them will undoubtedly help influence shoppers to buy.

How does ranking your category vs others help you understand your category’s role and performance? Here is an overview about the power of benchmarks.

If you enjoyed this blog post about beer shopping behaviour, there is more for you. Look around in our Resources section! Got questions about your categories? Contact us to speak to an expert.

All data in this blog post by Shopper Intelligence UK. Online survey of n=39,500 UK shoppers in all UK multiples in May-September 2020.