These insights about beer shopping behaviour were first published as part of The Grocer’s Alcohol Category Report 2020.

From Lock-in to Lockdown: changes in Beer Shopping Behaviour during Covid

Corona anyone? This may have sounded like a tasteless joke as we entered this pandemic.

Yet, somewhat ironically, the Mexican lager brand has seen a 40% increase in its UK sales in 2020 (Nielsen). See more about the top winner brands in this Guardian analysis.

While pubs were closed, at-home alcohol consumption took up about half of the on-trade drinking occasions. That’s an extra half a million litres of volume, an 18% increase vs previous year (Kantar). You can read more about it in the alcohol category report in The Grocer (featuring also the data in this blog post).

Beer has been the second fastest-growing alcoholic drink during Covid. The category increased +27.3% in value, just after Pre-mixed drinks (+28.6% – Kantar).

So, Low-Alcohol Drinks (LADs) producers had to turn attention to the supermarket shoppers. This meant understanding beer shopping behaviour, needs and motivations. This way they could make the best of the shift from on-premise to off-premise volume

Beer and Cider shoppers love promotions

To understand beer shopping behaviour, we used our online survey of 39,000 UK shoppers. The shopper database includes n=555 Beer/Cider shoppers.

What do Beer and Cider shoppers care about? The top 3 aspects are: Quality, Price and Assortment. These aspects are usually high for almost every FMCG category.

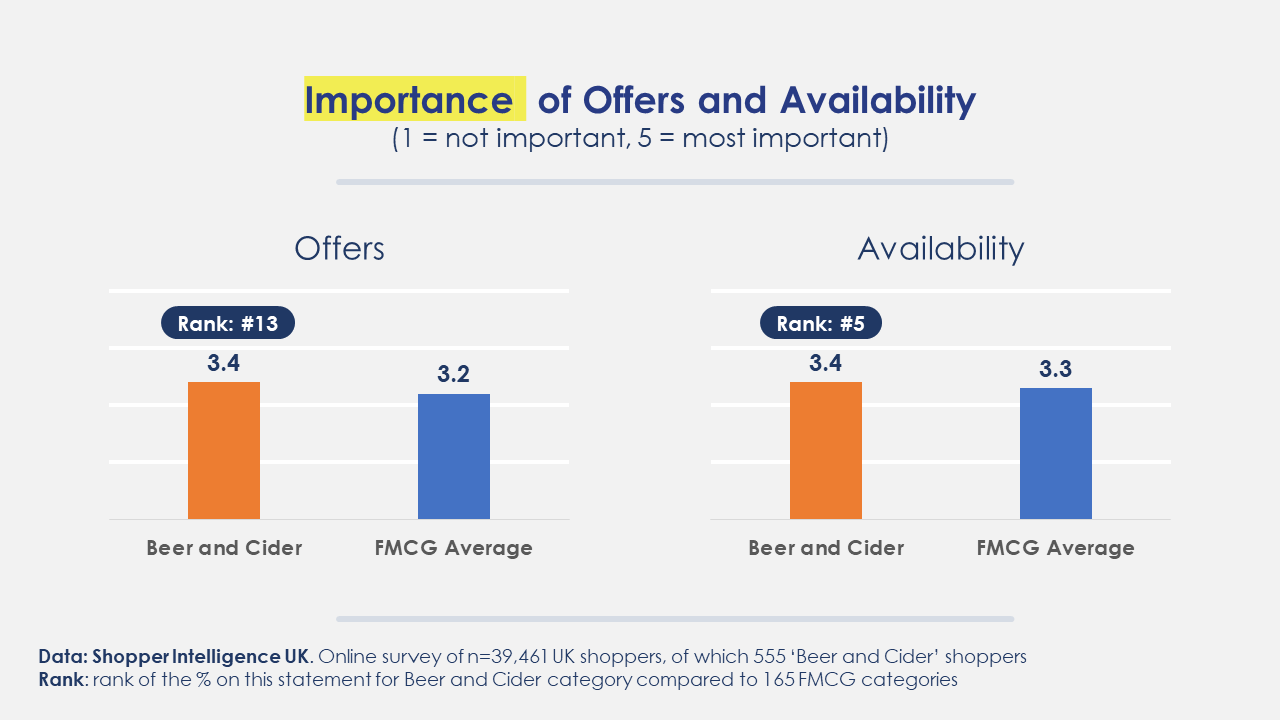

However, Offers are clearly more important to Beer and Cider shoppers than others. Beer & Cider ranks #13, meaning it has the 13th highest score amongst 165 FMCG categories on this metric. The importance rating of Beer & Cider (3.4) is above the FMCG average (3.2).

Beer and Cider promotions bring traffic to the store

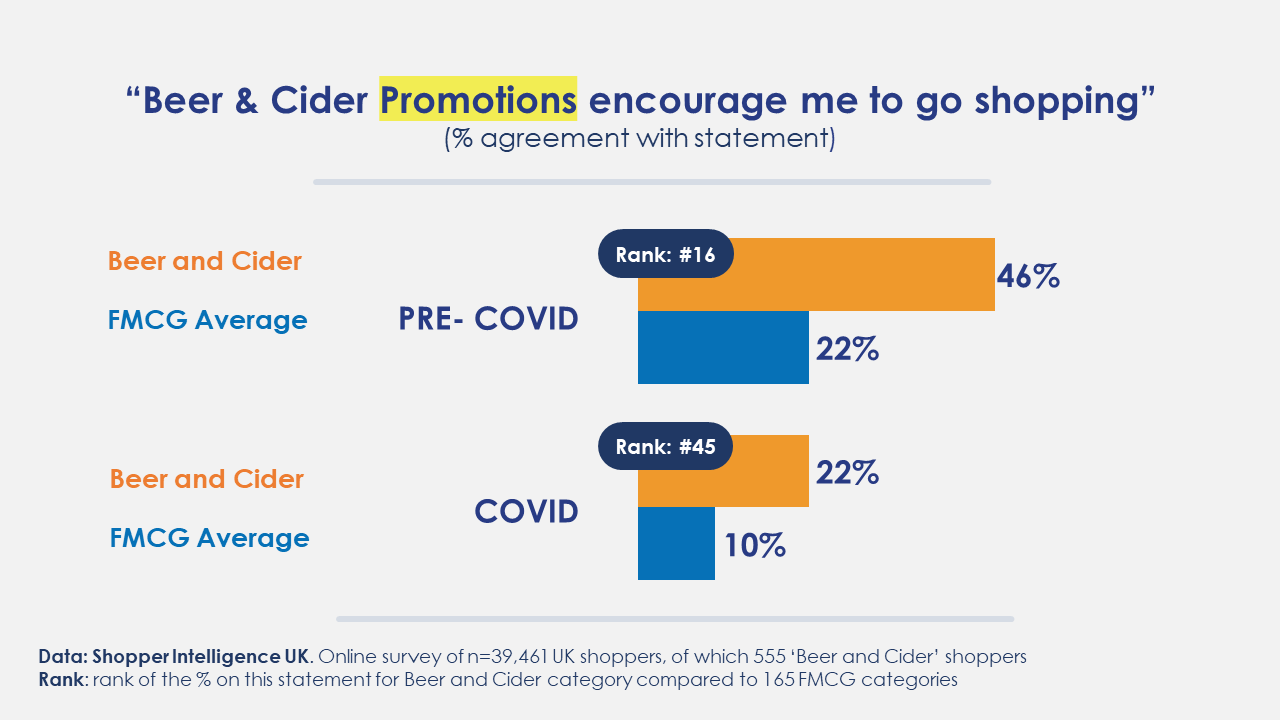

It’s therefore no surprise that offers in Beer and Cider attract shoppers to retailers. High shopper sensitivity to pre-store promotions (such as leaflets) make Beer and Cider a good Traffic Driver.

22% of Beer and Cider shoppers agree that “Promotions in this category encourage me to go shopping”. This is only 10% in the average FMCG category.

It’s interesting to note that since Covid, this promotional impact has reduced (from 44% in 2019 to 22% in 2020).

Availability is an issue for Beer and Cider shoppers

Once shoppers are in-store, Availability becomes critical for Beer and Cider. Shoppers attach high importance to Availability (3.4 versus the FMCG average of 3.3).

Still, there are some issues with Beer and Cider. Shopper expectations around availability are not currently being met. Beer & Cider shoppers are less satisfied than the average with products being Out of Stock. 50% say “I rarely have to leave the store or buy something else because the retailer is out of stock of my choice”. The FMCG average on this statement is 56%.

Beer and Cider shoppers want more choice

Another area where Beer and Cider shoppers are dissatisfied is range. These shoppers’ main request for improvement is “stock products I can buy elsewhere”. 19% of Beer and Cider shoppers are asking retailers to close the range gap. The average of all the 165 FMCG categories is only 12%.

Clearly choice is missing.

If you enjoyed this blog post about beer shopping behaviour, there is more for you. Look around in our Resources section! Got questions about your categories? Contact us to speak to an expert.

All data in this blog post by Shopper Intelligence UK. Online survey of n=39,500 UK shoppers in all UK multiples in May-September 2020.