The four crucial missing questions (and answers) in Cat Man about Category Role

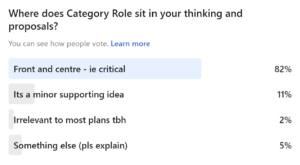

My recent LI poll on “Category Role” (see below) shows that most of us in cat man feel this is a topic that is crucial to our thinking. But let me today pose a question today: “how do we measure it”?

Whether you are a retailer making decisions on what categories you pick to achieve specific strategies for your store (eg drive footfall or build basket size, or even deliver a price message to the market),

Or you are a supplier working to convince your buyer to adopt your proposed plans as being a good fit for their goals….

it’s a powerful start point to focus on what this category is best able to achieve. What are the fundamental characteristics that it brings to the store – ie to your target shoppers? What makes it different?

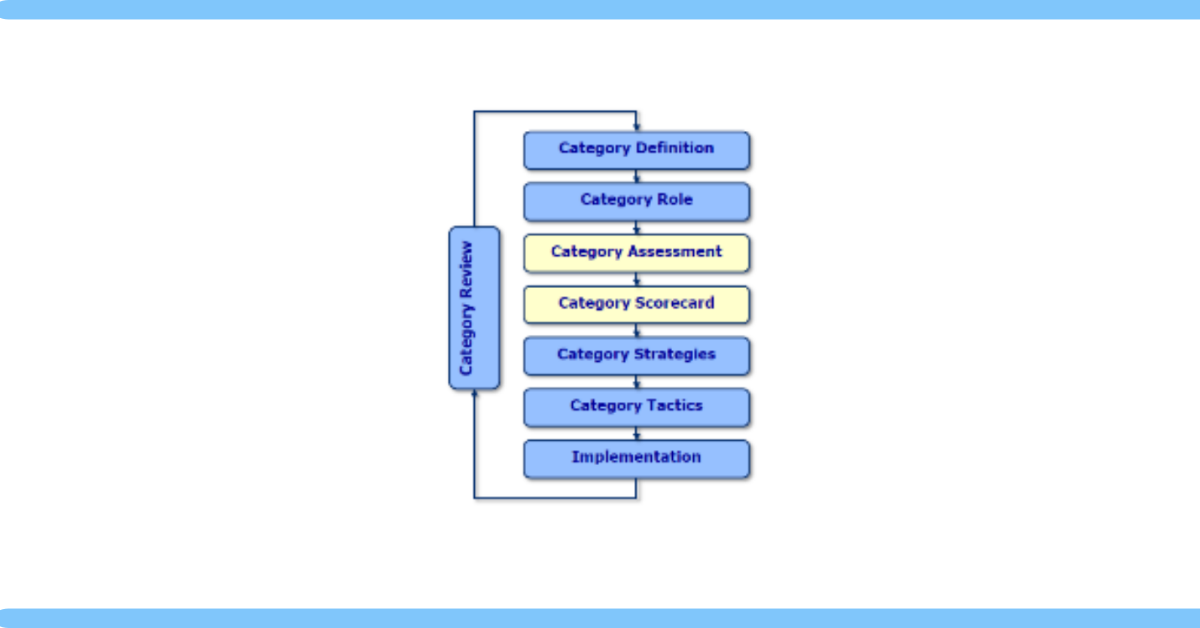

Given this is a key step of Dr Brian Harris’s original 8 step process, it’s been a puzzle to me that for so long this has been a very subjective debate. Asked in a meeting of buyers across a supermarket trading floor “who has a traffic driving category?” and pretty much every hand goes up. Of course, every buyer wants to win more resource for “my” category. Even more so for a supplier passing insights over for their buyer to then argue the case internally. Objective data is needed to win the day. After all, a supplier gains if a category gets more promotional, display or even shelf space. And these things are in short supply.

If you are in the school of “it’s a choice for the retailer” (which is a perfectly valid point over the long term), that still begs the questions “what is it now?” or more importantly “How are we tracking against the chosen role strategy?”If you are more concerned with basing your plans on what shoppers care about, regardless of the retailers preconception, then the need to understand it with objective insights.

What data can the Industry bring to this discussion? Behavioral data is important. Knowing the sheer size of the category, its growth, our share in it, its demographics and things like penetration and frequency all point to why any particular category “matters”. You get these of course from Loyalty card or Panel data. At least for your own category, anyway.

The Shopper Perspective:

But I’d argue however the discussion is far more nuanced. A frequently bought category may be put in the trolley often, but that doesn’t necessarily make it truly “important” to shoppers or that they pay it a lot of attention (milk anyone?)

The shopper themselves have to come into the debate. How do they actually see any particular category? The shopper view point is a crucial one. When we started our business, we saw that objective data on this were largely missing from the Industry data set.

Relativity:

The other challenge with data around “Role” is that this is an inherently relative matter. What a retailer should think about is the merits of category one to another. All categories might have some impulse buying. All might have some price sensitivity but a strategist has to make choices. One has to decide to focus limited resources on one category rather than another. So, our data must allow us to compare across all categories using the same metrics.

To illustrate the point, I remember well a canned soup supplier getting very excited that research showed that their category had 15% impulse buying. They proposed off shelf displays to their buyer. Embarrassing. Canned soup in truth has one of the lowest levels of impulse buying of any category in a store. Sounds obvious in hindsight. But this scenario is repeated day in day out across our profession.

This I fear has been where Cat Man has been limping along with one hand tied behind its back for far too long (pardon the mixed metaphor). Suppliers don’t get access to more than the limited categories they purchase from traditional data suppliers. Thus whole of store comparisons are not possible. Old school one off shopper insights projects (because expensive) are inevitably narrow in scope so don’t really show how this category differs to others, rather they just tell us in isolation how it ”works”.

I’d argue that the absolutely crucial 4 direct shopper questions to inform category role, and to know relative to the rest of the store are:

- Is it decided pre store or in store?

- Do shoppers want to invest time into the purchase process?

- Is it intrinsically high or low loyalty?

- What aspect of the experience matters more to the shoppers?

One could add subsidiary points like what missions it dominates, whether its about immediate or later use, the nature of its promotional response and so on, but I think the above are the “Big 4”.

You will notice that these questions are ones only the shoppers can answer for us.

I know. This all seems a bit of a sales pitch for what we do here at SI. But I hope you will agree that an objective shopper input into category role, equipped with whole of store comparisons is potentially a worthwhile addition to your data and onwards to your recommendations and decisions. Particularly as competition for resources grows ever more intense.

And as my poll shows, everyone thinks Role is an important issue for category strategy…