Category Role. Time to update the old classics?

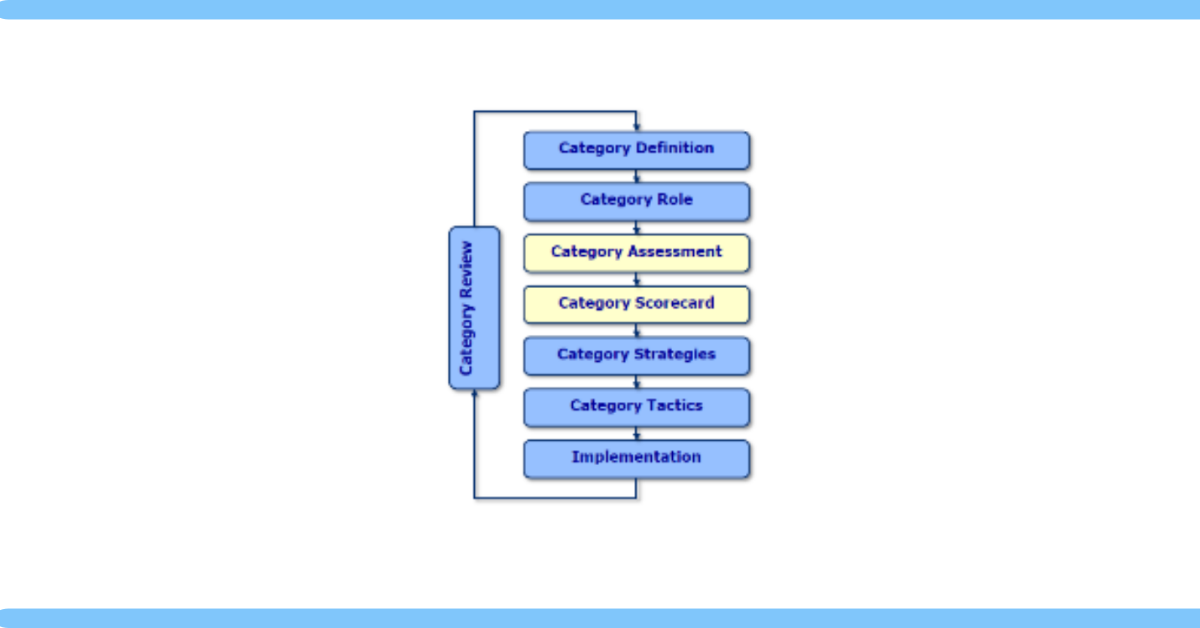

Remember Step 2 of the Eight Step Process anyone? Define the Role of the Category.

Well, how did that work out for you?

It was an important consideration. Pointless to propose strategies that were a mismatch for what a retailer sought to achieve “top-down” with that category. In a limited space environment, tough choices need to be made on what for example, gets more or less range, as well as greater or lesser merchandising spend.

If you want a reminder, click on the link below:

But for us, the content of the Role discussion was weak. It lacked shopper data (particularly comparative data). I used to discover most categories ended up (after largely fact-free discussion) being stuck in the bucket called “Core”. Which frankly didn’t give much help us in our drive for growth. We’d all love to be “Destination” – but the textbook said only a few could be that. Hmm.

Well, I think it’s time to re-think this whole matter and rather than using guesswork and falling back on an unhelpful bucket called “Core”, we should try to understand Role based on what shoppers think, want and do. This is at the heart of Shopper Intelligence, and by talking to shoppers, we can understand in great detail exactly what role any category, segment or brand plays to the store from their point of view and thus what to recommend to the retailer. And if we want to drive change, we can objectively see what levers to pull for best shopper and hence store impact.

We have built a new data-driven model, based on two axes – Intentionality and Engagement. Loosely speaking, the former is showing characteristics stronger for bringing in shoppers to the store, the latter for getting them to spend more once in the store. Better able to drive Footfall, or Basket spend. Categories can be strong on one or other, or both or neither. What that leads to is a four-box quadrant model as shown below. Your category, brand or segment can have characteristics that place it in this model, and hence you know what strategies make the most sense. It tells you if your category is truly distinctive on any dimension so that you can use that in your thinking.

The power of this is rather than most categories being labelled as being rather grey “Core” and the debate stopping, now every category can build a relevant strategy and propose useful plans to each retailer (the outcome differs by banner and channel of course) based on what its shoppers want.