80/20: Today’s Insights Reality

Back in the day, most larger CPG firms had massive human resources, and budgets for data to match. There was the capability to strive for the optimum within insights and data solutions.

Things have changed. CPG is under pressure as never before, as growth slows and retail competition heats up. Companies react by slimming down headcount, with often analysts being in the firing line. Data budgets are under huge pressure. There is a hope that better software and even AI will step in to solve the problem.

Certainly, the software is doing the far more heavy lifting than ever before, and the toolkit keeps improving, but AI hasn’t yet really solved the fundamental problem that it takes human intelligence and time to mine all the computer data outputs to find true insights.

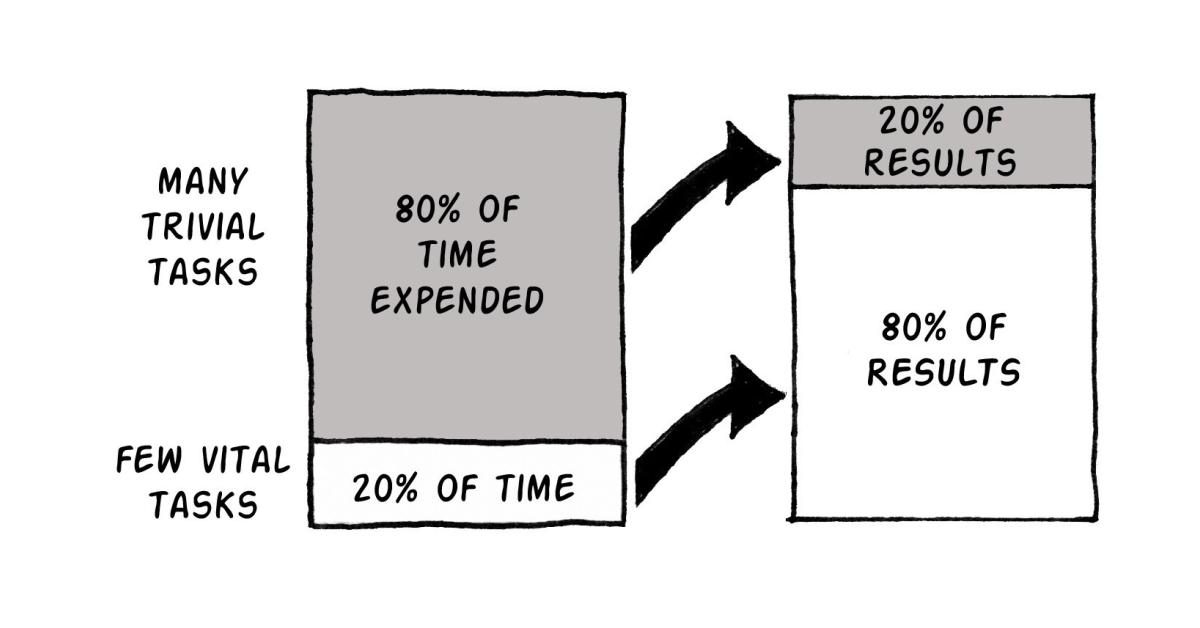

That’s where 80/20 comes in. The Pareto principle – named after the 19th Century accountant Vilfredo Pareto but originally called the “principle of factor sparsity” (try that one in your next team meeting!). Did you know Pareto was originally about 80% of the land in Italy is owned by 20% of the people? Now it’s most often used to talk about 80% of sales coming from 20% of customers. More broadly, the idea seems to be useful for almost any resource. Instinctively, we recognise that 20% of our time generates 80% of our output.

80/20. It can be our friend, and for those of us wrestling with generating insights, the 80/20 principle is crucial.

If you try to analyse all the data, you will surely drown if you try to solve every problem, goodbye evenings and weekends. The only solution in today’s tight environment is to find 20% of problems and 20% of the data that will help your business get 80% of what it wants.

How do you do that? Here’s my suggestion:

Step 1: ask the question “what problems/issues/opportunities are the biggest”. Find out from your “clients” (whoever is receiving your work) what they care about the most, i.e. what has the most commercial impact. Don’t accept a laundry list of issues nor vague generalisations, e.g. “what’s going on in the category?”. Questions like “what’s that worth in dollar terms” or “if we could tackle just one of these which would it be” may help.

Step 2. Use “answer first”. Build sensible hypotheses. Don’t just dive in and start digging in your data. Step back and think. What might be going on? Where are the more likely causes? Look there first. And if you find good answers, maybe that’s enough? I understand the dangers of glib answers but remember Ockham’s razor!

https://simple.wikipedia.org/wiki/Occam%27s_razor

Step 3. Check your answers suffice. Don’t keep on keeping on just to have more and more “stuff”. Go back to the client/problem owner and ask: “Does this answer your question?”. Chances are it may be answered far more simply than you had first thought.

Embrace 80/20. It’s not a perfect world. Chasing perfection will run you into the ground. Looks for good and look for “enough”.

What do you think about this?

Here at Shopper Intelligence, we like to say that our tool is the 80/20 of shopper insights. 80% of what you need to know for 20% of the time & cost of custom research. We find our clients like that!